What is your view on recent energy market interventions, especially the Council’s initiative to use windfall profits?

Though we are a public company we also understand the importance of solidarity in these difficult times, and are now focusing our activities on ensuring energy security for the forthcoming winter. As for the windfall profits – our company was impacted by rising costs of coal and carbon emission allowances (EUA), so we can speak of the higher costs and not just of the higher revenues.

Our energy portfolio in the PGE Capital Group is (for now) based mainly on coal and lignite, this situation is different compared to other companies, for example those in Spain, where the non-emitting installations (renewables, nuclear, hydropower) accounted for 66 per cent of power generation last year and profited from higher energy prices. For Poland this figure was merely 16 per cent.

This means that the widely discussed inframarginal profits exists mostly in countries, where non-emitting sources constitute most of the energy mix. In countries like Poland, still dependent on fossil fuels, the trend in rising prices and carbon costs, mean generators have higher operational costs.

Despite the crisis and challenges, our commitment to achieve carbon neutrality by 2050 is still relevant

What should be done to accelerate energy transition and achieve the goals set by the REPowerEU plan?

We need quicker permitting procedures and adequate financial incentives for distribution grid development in order to follow a high rise in the renewables’ projects in micro installations. Prioritising areas where the grid connections’ potential is greatest to fully utilise the distribution grid capacity and synergies within existing infrastructure.

To accelerate this we need additional funds. The European Commission’s initial idea to use carbon emission allowances from the Market Stability Reserve for investments under the Recovery and Resilience Facility was a good one, ensuring extra resources for more ambitious climate goals. But the Parliament’s proposal of frontloading – i.e. the quicker auctioning of member states’ allowances – will not solve this issue, as revenue from these allowances would be used by member states anyway.

Apart from investment, our sector needs stability. We are currently converting coal-fired CHP plants to renewables and mainly low-emission fuels, to reduce GHG emissions, and in the future our plants can use renewable gases when available. Today we see a trend to mix the discussions about Russian gas with the the role of natural gas in general. But to ensure stability our sector needs, and while, without doubt, we must get rid of Russian gas, we know that gas coming from diversified suppliers (non-Russian) still plays an important role in some sectors like district heating, especially in the short-term.

What impact does EU ETS have on the energy trade and PGE’s investment opportunities?

Discussions in Europe focuses mainly on the price of natural gas as the main driver behind rising energy bills. But for Poland high prices on the EU ETS market have a more profound impact. During the January-August period they were responsible for 25-56 per cent of the average monthly price on the electricity wholesale market (three times the EU average). It goes without saying these increasing costs as well as market volatility imposes a serious burden on our company. Costs of EUA for our company increased from €0.75 billion in 2019 to €1.9 billion in 2021 with prices further incrasing.

These resources (over €1 billion) would have otherwise been used for the investments in our green transition. So, creating a “vicious circle” in which rising EUA prices drain funds that could have been used by companies to invest in renewables to lower emissions. Because of lack of funds used to cover carbon emissions, companies like PGE have to use existing installations to generate power and heat.

What impact does speculative trading has on the market?

We are aware there are many factors impacting EUA costs . Rising prices of coal and natural gas, or market reactions to the EU’s legislative process all play a role. But there is no reason why we should continue to allow investment funds to have unrestricted access to the EU ETS market. Some financial institutions improve the liquidity of the market, ensure price discovery and trade on behalf of compliance entities. However, there’s no reason to allow market players with long�term buy and hold strategies operate solely for the profit to increase prices and market volatility.

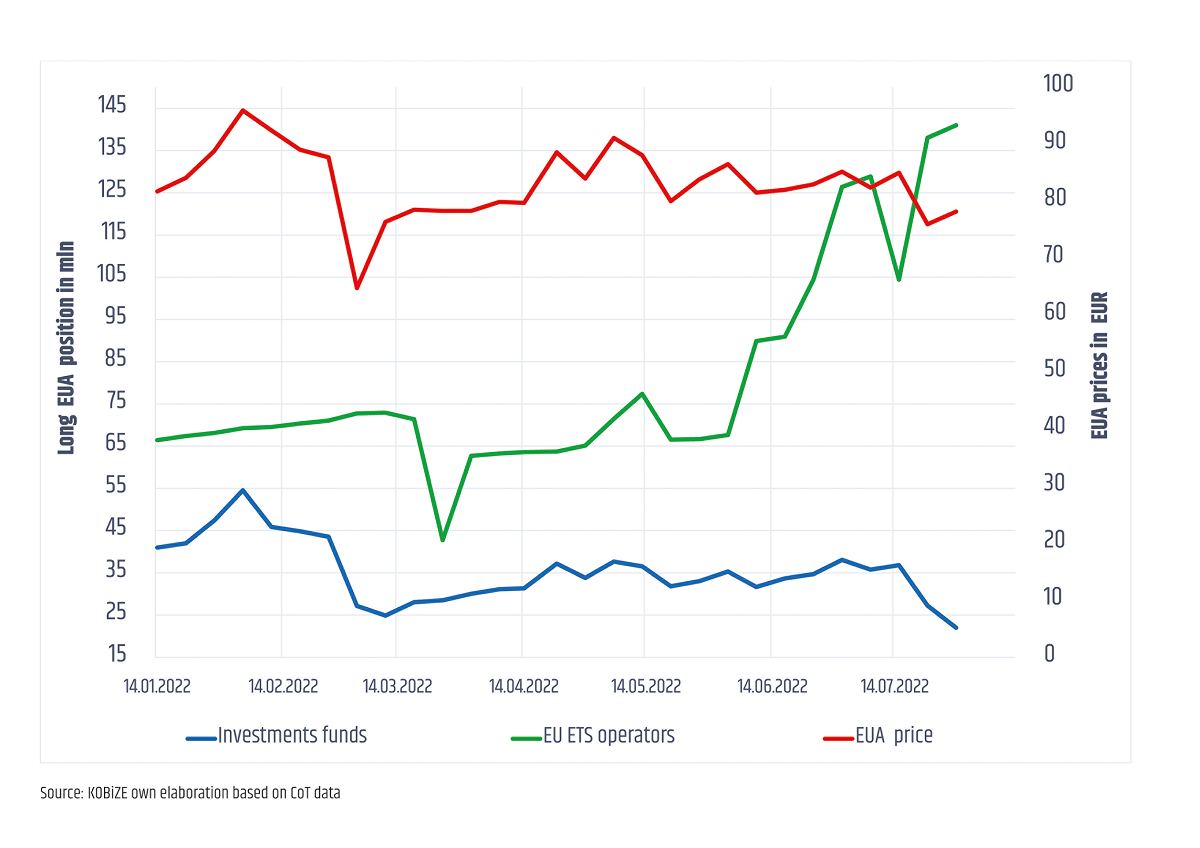

Concerns about the role of speculative trading were reflected in a recent Parliament resolution on the EU’s response to the increase in energy prices. This resolution highlighted the EU ETS market volatility with high risk speculations showing these issues are still of lively discussion in the Parliament. Right now, this above all is of utmost importance, as these issues have a negative impact on the liquidity of the energy market, and since power generators have to secure higher capital for carbon allowances, this prevents them receiving necessary investments. Speaking about the role of financial speculation on the EU ETS market, I have in mind a chart prepared by experts from the Polish National Centre for Emissions Management (KOBIZE), showing that throughout this year there was a strong correlation between long positions taken by investment funds [blue line – PM] and EUA prices [red line – PM].

The compliance entities, who are actual emitters [represented by the green line – PM] have to react to price movements which benefited investment funds. The share of investment funds in the carbon market with usually long-term buy and hold strategies (constituting ca. 5%) is too small to provide liquidity, but is high enough to drive up prices further – as observed recently.

Market data suggests financial actors benefit from the high prices of EUA and their participation in the EU ETS market should be limited to actual intermediaries (acting on behalf of energy companies).

What is PGE’s message to readers? What is the long-term goal of your company and how does the current crisis impacts this?

Despite the crisis and challenges, our commitment to achieve carbon neutrality by 2050 is still relevant. We are currently investing in offshore wind farms in the Baltic Sea. It will be our key clean energy asset: we will develop 2.5 GW from offshore wind farms by 2030. By then we also aim to reach approxiametly 1.7 GW in onshore wind farms and 3 GW in photovoltaics, and exit coal use in the heat generation. This plan is very ambitious and the current winter especially during the heating season will be challenging, but we will deliver our promises of providing secure and clean energy.

Sign up to The Parliament's weekly newsletter

Every Friday our editorial team goes behind the headlines to offer insight and analysis on the key stories driving the EU agenda. Subscribe for free here.